Trust income vested in non-residents: proposed amendments

In terms of current law, should trust income be vested in a discretionary beneficiary of such trust during the same year of assessment in which it is received by or accrues to the trust, the income flows through the trust as a conduit and is taxed in the hands of the beneficiary. This is the case regardless of whether the beneficiary is a tax resident of South Africa or not.

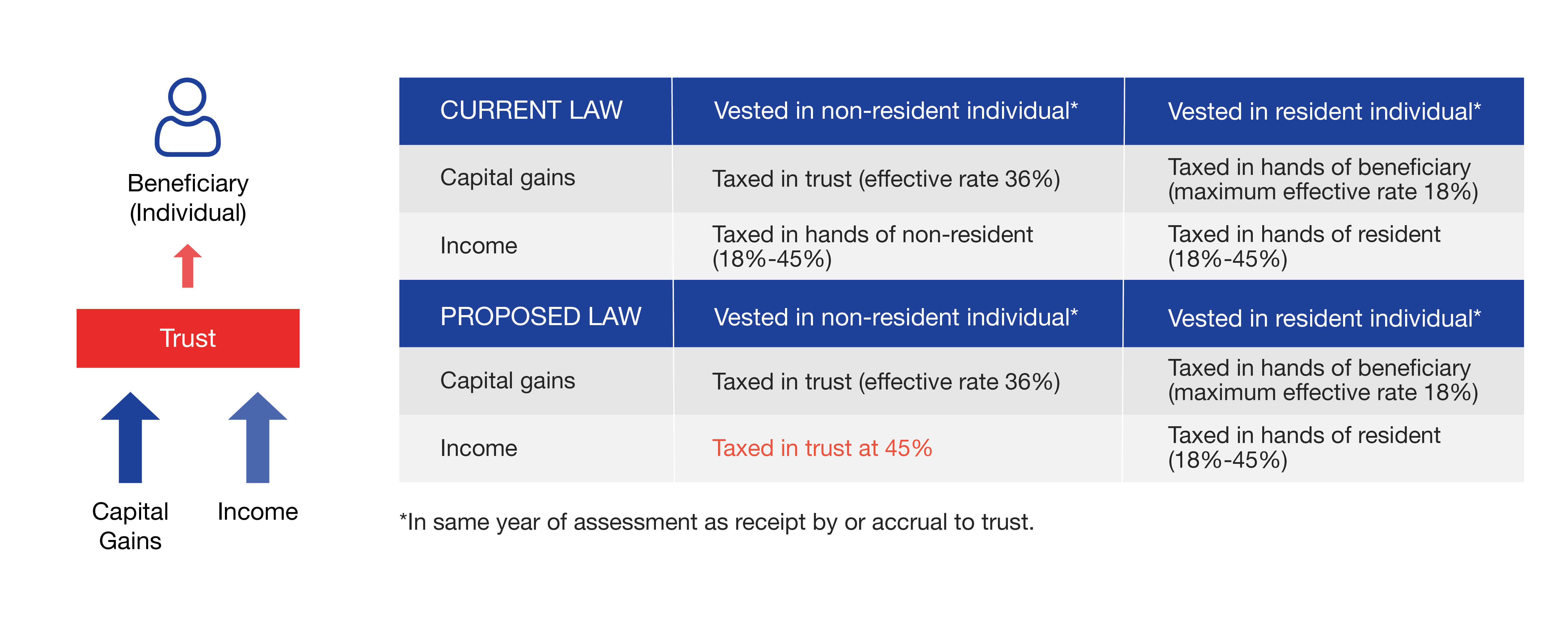

In contrast, capital gains realised by a trust which are vested in a beneficiary during the same year of assessment give rise to different tax consequences if distributed to a non-resident beneficiary as opposed to an SA tax resident beneficiary:

- capital gains realised by a South African trust and vested in a South African tax resident beneficiary will be subject to income tax in the hands of such beneficiary;

- capital gains realised by a South African trust and vested in a non-resident will be subject to income tax in the hands of the trust (i.e., the tax is “trapped” in the trust).

In accordance with proposals made in the Budget Review during February 2023, and the draft Taxation Laws Amendment bill it is proposed that the taxation of trust income vested in a non-resident beneficiary is to be aligned with the manner in which capital gains vested in non-resident beneficiaries are taxed.

The impact of this proposal may be illustrated as follows:

In terms of the draft legislation that has been published for public comment this prosposed amendmentis deemed to come into operation on 31 July 2023 and appears in respect of any years of assessment ending on or after the date.

This effective date means that the proposed amendment is applicable retrospectively as any distributions of income made to non-resident beneficiaries prior to 31 July 2023 (i.e. from 1 March 2023 to 30 July 2023 the period which falls with the 2024 year of assessment) is subject to this new legislation. It is however noted that at this stage, public consultations will still be taking place for National Treasury and SARS to decide on the implementation of this proposed amendment but it is advised that trustees err on the side of caution in making any distributions of income to non-resident beneficiaries until such time as there is certainty on the taxing of such income.

Upon the legislation being implemented in this regard it may be prudent for South African trusts to obtain advice in relation to the attendant tax implications prior to vesting any amount in a non-resident beneficiary.